EVs At 23.5% Share In France — Plugins Dip As HEVs Surge

Support CleanTechnica's work through a Substack subscription or on Stripe.

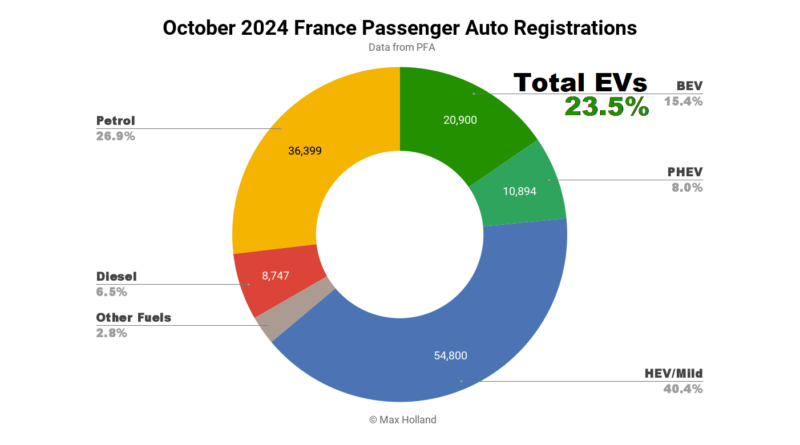

October’s auto market saw plugin EVs at 23.5% share in France, down from 26.5% year on year. Classic hybrids (HEVs) were the only powertrain that saw YoY growth, with plugins losing ground, though faring better than combustion-only vehicles. Overall auto volume was 135,532 units, down 13.3% YoY. The new Citroen e-C3 was France’s best selling BEV in October.

October saw combined EVs at 23.5% share in France, with full battery electrics (BEVs) at 15.4%, and plugin hybrids (PHEVs) at 8.0%. These compare with YoY figures of 26.5% combined, 16.7% BEV, and 9.8% PHEV.

Even against the backdrop of an overall auto market that shrank 13.3% YoY, both BEVs and PHEVs still lost market share, due to even bigger volume drops than the market average. This is not great.

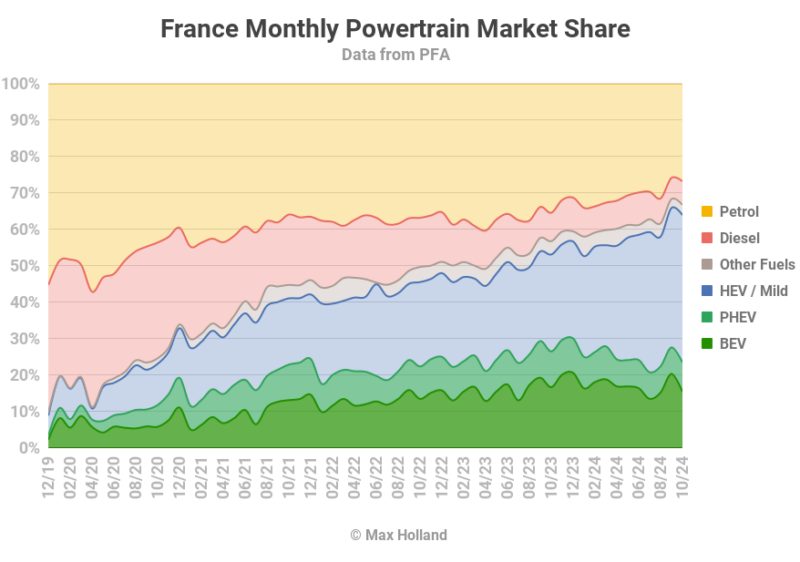

Only plugless hybrids (HEVs and mild hybrids) saw YoY growth in October, jumping strongly from 26.6% share to 40.4% share, and now the largest powertrain share of the market. It bears repeating that HEVs are 100% dependent on combustion of fuels for their energy source, and cannot drive on renewable electricity alone (unlike BEVs and PHEVs).

HEVs rely on a transitional technology whose innovation peak was the late 1990s and early 2000s. If Norway is any guide to the automotive future (and it is), HEVs will peak in the next year or two, and thereafter lose share (currently down to just 1.1% share in Norway) as BEVs gradually take almost the entire auto market. HEVs’ current lead is also, in part, a consequence of France cutting incentives on affordable BEVs from outside Europe, and more recently voting for additional tariffs on the best value BEVs, those made in China. See the August report for more discussion.

Meanwhile, combustion-only powertrains continued to decline. Diesels fell to 6.5% share, from 7.8% YoY. Petrol fell to 26.9%, from 35.5% YoY.

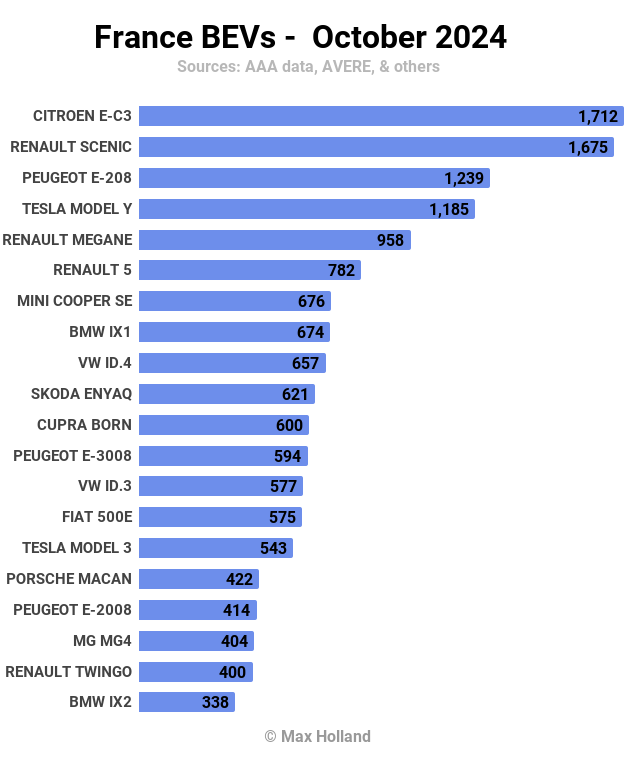

Best Selling BEV Models

Following the rush to meet the September deadline for the Social Leasing Programme, the new Citroen e-C3 fell back to roughly half that volume in October, with 1,712 units. That was still enough to give it the top spot for the month, however.

In second place was the Renault Scenic, with 1,675 units, and the Peugeot e-208 took third, with 1,239 units.

Following the previous two months at the top, the Tesla Model Y dropped to fourth in October, with 1,185 units.

The new Renault 5 kept close to its September volume, taking 6th with 782 units. Most others were familiar faces, with just one or two exceptions. The new Porsche Macan had a strong month in October – relative to its premium price-point – with 422 units and 16th spot (its first time in the top 20).

As usual, we only have limited model data from the French market, so we can’t detect new models which may have debuted in the past month. If you know of any debutants, please let us know in the comments below.

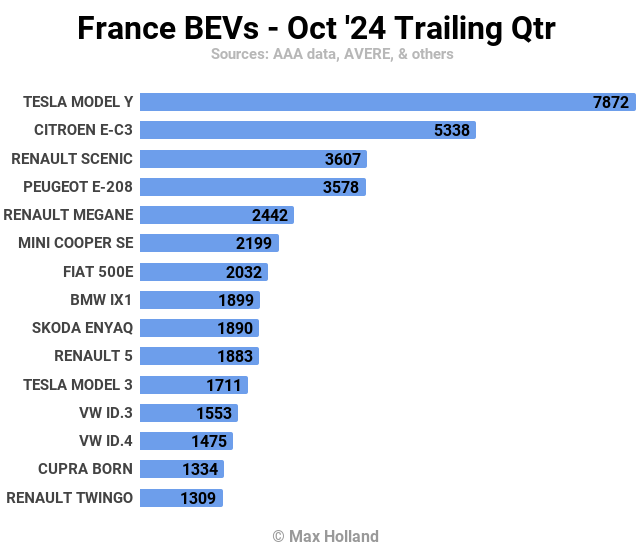

Let’s get an update on the 3-month rankings:

After strong deliveries in August and September, the Tesla Model Y still has a healthy lead in the 3-month chart, despite a more modest October. With two decent months under its belt, the new Citroen e-C3 is now in a solid second place, comfortably ahead of the Renault Scenic, and Peugeot e-208, which are closely competing for 3rd spot.

Further back, the Renault 5 has also done well to climb to 10th after only two months of volume sales. If it continues on this trend, it may join the top 5 in the next month or two.

When will the new Renault 4 (the Renault 5’s platform-sharing SUV sibling) debut in Renault’s home market? My tea leaves are suggesting early 2025, but please jump in the comments if you have local knowledge.

Outlook

Despite the delivery debuts of the much anticipated Citroen e-C3, and Renault 5, the French BEV market is still significantly down in volume YoY, a deeply disappointing result. One suspects that manufacturers may already be starting to slow-pedal the delivery of BEV volumes for the remainder of 2024, in order to release those volumes in 2025, when EU regulations require tighter fleet average emissions to be met.

The shrinking YoY auto market is roughly in tune with the broader French economy, whose Q3 2024 gross output was reported to be 1.3% up YoY, a slight improvement over Q2 (1.0%), but far from the ~2.5% annual growth of the late ‘90s and early 2000s. Inflation was roughly flat at 1.2%, the interest rate was 3.4%, and manufacturing PMI was flat at 44.5 points.

Do you agree with me that we won’t see consistent annual growth return to the French BEV market until 2025, when the next round of emissions tightening regulations come into effect? Which model debuts are you looking forward to? A you planning to get into an EV in France in the near future? Please let us know in the comments section below.

Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica's Comment Policy