Latin America EV Sales Report, Part 3: Leaders on the Podium (Colombia, Uruguay, Costa Rica)

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

And so we get to the last part of our report, regarding the three countries leading the region in EV sales. This podium has been stable for years, but, if the situation in January is to last, important changes could be upon us. However, as far as 2023 goes, these were still the leading countries in the region.

If you wish to read the previous parts of this report, you can do so here:

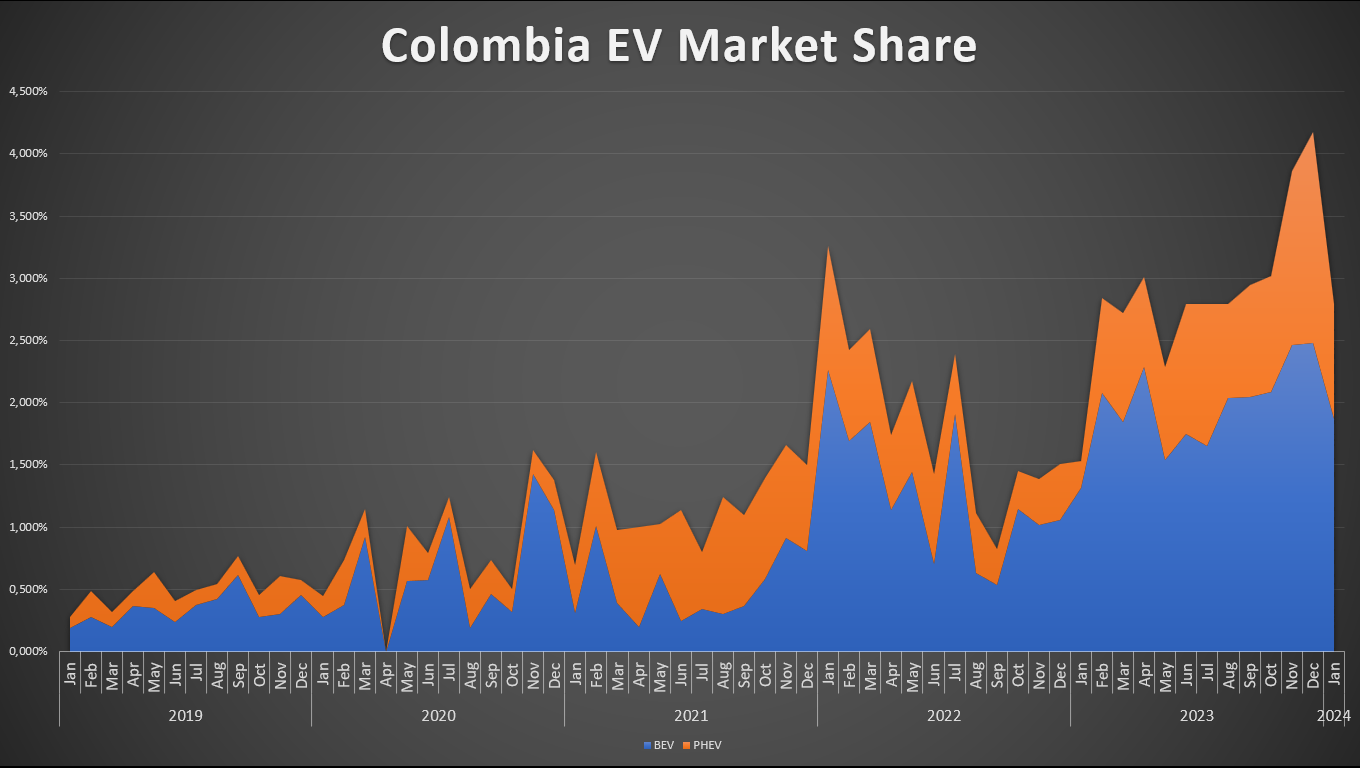

#3. Colombia (2.9% plug-in vehicle market share)

Third in our ranking is Colombia, a country with a relatively small car market compared to its population. Despite being the third most populous country in Latin America (behind Brazil and Mexico), it’s only the fifth biggest automotive market in the region, with 186,826 light and heavy vehicles being sold in 2023. Of these, 3,718 were BEVs (2%) and 1,799 were PHEVs (0.9%).

The Colombian EV market is particularly complex to understand: two factors skew the data so that a growing market appears to be nearly stagnant. First, there’s the purchase of over 1,500 electric buses, most of which were delivered in H2 2021 and H1 2022. Once the last of those were delivered in July 2022, growth became more clearly visible.

And second, there’s the fact that the Colombian vehicle market is in freefall. A perfect storm of high interest rates, low economic growth, and massive devaluation (the latter having subsided in late 2023) caused total vehicle sales to collapse, falling 30% in 2023. This means that relatively slow EV growth became comparatively larger proportionally.

In recent years, the market has gravitated towards 30% PHEV and 70% BEV, with PHEVs gaining more traction since BYD brought its DM-i line into the country. Since the overall market is falling, market share has actually increased by quite a bit more than total sales.

As we can see, the country was not far from reaching 5% plug-in vehicles in December, but the rate of growth (averaging 43% yearly in the last 4 years) seems disappointing. Colombia is bound to lose its position on the podium if it doesn’t speed up in 2024. It’s worth pointing out that January is always a slow month, and that year on year there was a 52% increase in EV sales between January 2024 and January 2023.

As far as the EV market goes, the Chinese once again dominate, with the entire podium and 6 out of the 10 most sold models being from this country, three being from Europe (counting Volvo as European), and, surprisingly, one being Japanese.

Incentives for EVs remain (lower taxes, no VAT, no tariffs), but the single most important action that the Colombian government could take to promote them would be to review the benefits hybrids receive. Large Colombian cities, and Bogota in particular, have very strict restrictions for the transit of ICE models, but so far, hybrids (and even mild hybrids) have had the same benefits as PHEVs and BEVs. If those are removed, and only true EVs remain exempt, sales could get a significant boost.

Either that or a significant price reduction that brings EVs closer to price parity with ICEVs. Several brands have announced price cuts in the last few weeks, including JAC, Renault, JMC, and Seres. However, the reduction is still small, and the country is in dire need of more affordable prices if EVs want to have any hope of becoming mainstream. Great Wall Motor, and specifically the ORA 03, has already landed in several countries in the region at competitive prices … do they want to start a price war in Colombia?

In any case, the price cuts were announced in late January, so we won’t know the effects until the end of February.

#2. Uruguay (3% BEV market share)

Second in our list is Uruguay, a market that has grown steadily at rates similar to Mexico, but starting from a higher base. Uruguay also has one of the cleanest sources of electricity in the region, so the impact EVs make on carbon emissions is higher there. In 2024, a total of 60,478 light and heavy vehicles were sold, 1,799 of which were BEVs, for 3% market share!

Now, dear readers, believe it or not, I had to work quite a bit to get this number, because, get this: Nissan did it again! Just like in Ecuador, it managed to pass its hybrid X-Trail off as a BEV! Though, thankfully, the model sold fewer than a hundred units, so the data was not that skewed. It’s unbelievable that two countries have fallen for the same trick.

Uruguay has a very comprehensive charging network and significant benefits from EVs. It also has a very competitive market where, according to local media, average EV prices went down by 11% between 2022 and 2023, making them more affordable for people. The government is also providing incentives for taxis: 100 of them were given in 2023, but there’s no information on how many are planned for 2023.

Model-wise, the ranking is once again Chinese dominated, with 7 out of 10 models being from that country.

Most impressive of all, when looking at the most sold brands, BYD absolutely crushes the competition, getting 53% of the total market:

- BYD: 951

- JAC: 219

- BMW: 148

- Maxus: 76

- Volvo: 63

Uruguay also started 2024 with a strong footing, with BEV sales rising to 144 units out of 4,166 total sales, or 3.4% market share. That’s already ahead of 2023’s result. This also looks like a promising year for the Gaucho Country!

#1. Costa Rica (11.6% BEV market share)

We finish our raking with Costa Rica, a country that’s bolted ahead of every other one on the continent! No matter how far Brazil, Uruguay, or Colombia grow in the next couple of years, it’s hard to see them surpassing this small champion.

Costa Rica was already ahead of the region in 2019, but growth in later years was not particularly high (25% in 2020, 46% in 2021, 41% in 2022). However, things sped up dramatically in 2023, with 204% growth year on year! And so far in 2024 things are also looking bright, as Costa Rica sold 96% more EVs last month than in January 2023, making it the best-selling EV month in the country’s history!

Hybrids — including light hybrids and PHEVs — comprise less than 3% of sales in the country, so they can be safely discounted. This is one of the purest BEV markets there is, and the purest one I know about.

Market share is harder to calculate. Costa Rica’s official data presents EVs sold and registered by month (which is the data presented in the graph above), but the total vehicles registered are not available. Yearly imports are available instead, but these have a few months of mismatch with registrations, and BEVs would be underrepresented if measured that way.

The solution is to work with EV imports (present in a local blog from Ale Montero), some of which are still sitting on dealers’ lots and won’t be sold for a couple more months (and, as such, do not appear in the chart above). 6,312 BEVs were imported in Costa Rica in 2023, which comprise 11.6% of the 54,554 vehicles imported in these years. This includes light and heavy vehicles.

Model wise, once again we have significant presence from the Chinese, but in this case, four European models managed to make it into the top 10:

Costa Rica presents hope for European manufacturers: as the most developed EV market in the region, it has significant presence of European models, and it seems to be the first country where the ID.4 has made a landing.

Brand-wise, we have a much more competitive landscape than in Uruguay (where BYD stood alone at the top), and even one European manufacturer in the top 5!

- BYD: 1,183 units

- Geely: 984 units

- BMW: 440 units

- JAC: 386 units

- MG: 382 units

If January is to be an indicator, 2024 will also bring great growth to Costa Rica’s EV market, but it’s hard to predict where it will end. One can hope for 25% market share, but I feel somewhere around 17% is more plausible. Time will tell!

And so, we finish our report for Latin America in 2023. As I said at the beginning, this will be the last of such reports. In the future, I’ll report more often about countries where the market development is faster and leave a combined article for the laggards where there isn’t much news … for now.

Regardless, I hope you enjoyed it!

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica's Comment Policy