UK EV Share At 25.7% — 2024 ZEV Mandate Already Shaping Market

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Last Updated on: 7th December 2023, 01:48 pm

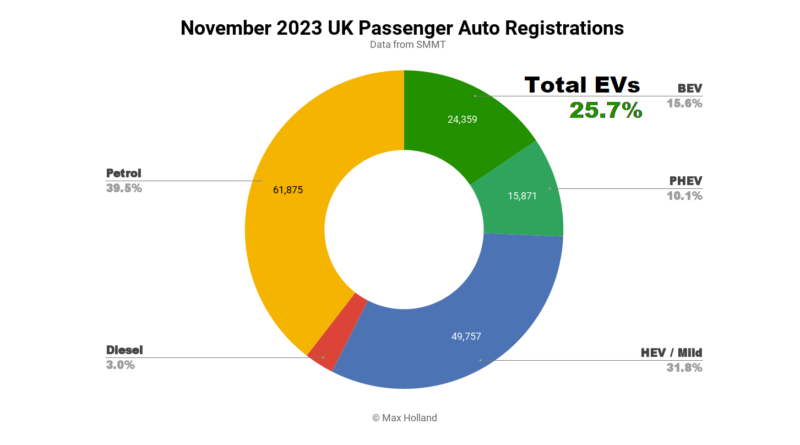

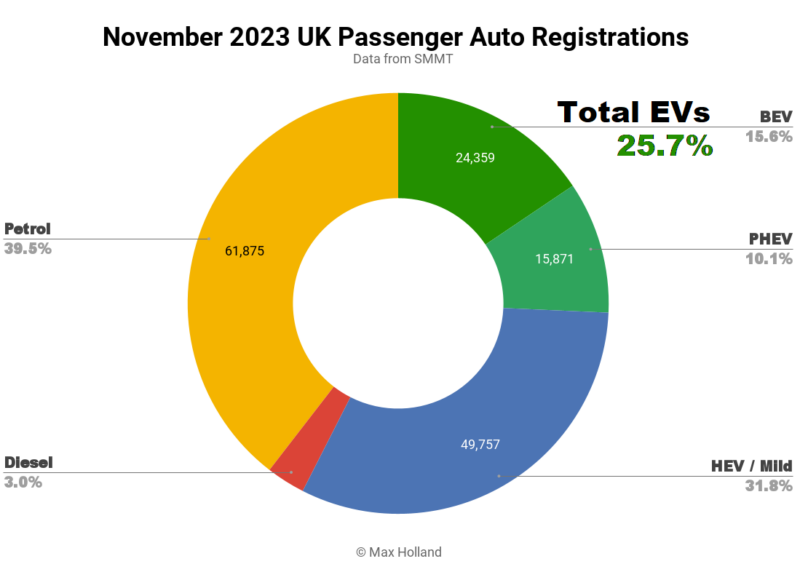

November saw the UK EV share at 25.7% of the auto market, down from 27.7% YoY. Plugin hybrid volumes grew by 56% YoY, whilst full electric volumes fell by 17%, potentially a hold-back ahead of incoming policy changes. Overall auto volume was 156,525 units, up 9.5% YoY, roughly in line with pre-2020 seasonal norms. Audi was the UK’s best selling BEV brand in November.

November’s market saw UK combined EV share at 25.7%, comprising 15.6% full electrics (BEVs), and 10.1% plugin hybrids (PHEVs). These compare with YoY shares of 27.7%, with 20.6% BEV, and 7.1% PHEV.

We can see that PHEVs are up, but that BEV share is notably down year on year. Even against an overall market YoY growth of 9.5%, BEV volume fell by over 17%, a very unusual pattern.

The SMMT claims that the November 2022 baseline for the YoY comparison was unusually high for BEVs, but the data does not support this at all. Instead, the data shows that the 2022 end of year uptick was closely in line with the trend that the UK also saw at the end of 2020, and 2021, along with the end of year trend in almost every other European market.

A more likely reason why this year’s end of year share is not seeing the typical uptick in the UK, is the imminent arrival of tighter “ZEV mandate” regulations starting from January 1st 2024. More on this in the outlook section below. Suffice it to say that many manufacturers are likely now holding back some of their late-2023 deliveries until 2024, to help them meet the first year requirements of the incoming ZEV mandate.

Given that November and December will be distorted by this strategic hold-back, there’s not much more to say about the exact numbers we are now seeing. Happily, diesel-only share continues to fall off, at a record low of 3% in November.

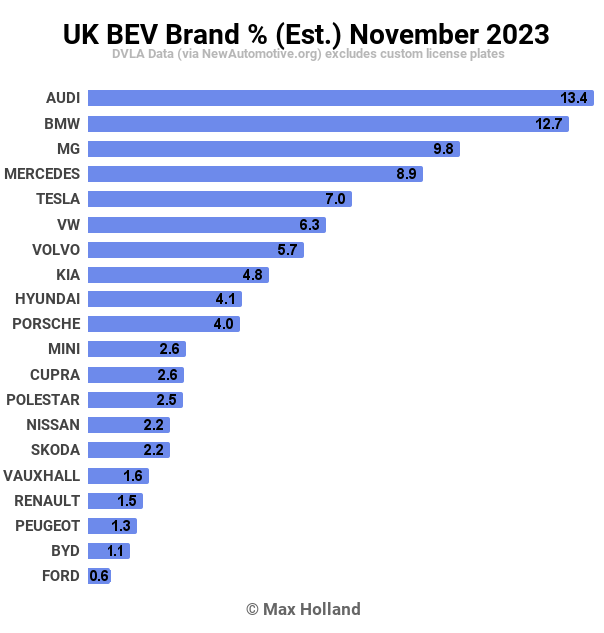

Best Selling Brands

Tesla was unusually low on deliveries for the second month of a quarter, likely also related to the incoming ZEV mandate. Their November 2023 volume was only 1,599 units, whereas their typical second-month-of-quarter volume over the past year has been more than 3,000, and their previous two Novembers both saw over 4,000 units.

Audi was happy to step into the gap, taking November’s lead spot, taking 13.4% of the UK BEV market, ahead of familiar faces, BMW and MG.

Due to the imminent ZEV mandate, and manufacturers strategizing their UK deliveries in relation to it, I’m not going to analyse moves in much detail this month, since they are ephemeral.

We should, however, note BYD’s strongest UK month so far, with 267 units, comprising the Atto 3 and the Dolphin. BYD’s UK delivery batching is still a bit patchy for now, but will no doubt even out as the brand becomes more established in the country. BYD is competing with MG for the best value BEV spot, but has a long way to go to match MG’s volumes.

Let’s look at the 3 month picture:

Tesla still maintains its lead, though at a much diminished gap over others, since its volume is only 71% that of the prior period. All the other top 20 brands grew their volume over the same period, except for Polestar and Vauxhall.

The coming few months in the UK BEV market will be messy, but we will be here to map it.

Outlook

Beyond the auto market’s reasonable health, the UK economy remains weak, with latest GDP YoY growth remaining at 0.6%. Inflation has reduced to 4.6%, and interest rates are flat at 5.25%. Manufacturing PMI increased to 47.2 points in November from 44.8 points in October.

As for the BEV outlook, the market faces disjunctions. The new ZEV mandate, starting in 2024, requires auto manufacturers to sell roughly 22% ZEVs (i.e. BEVs) in the UK, or face stiff fines. The actual numerical requirement is a bit more complicated — a politically fudged formula, designed to keep laggards like Ford, Honda and Toyota from following through on their threats to pull out of their UK factories and related investments.

Holding back what should be late-2023 customer deliveries of BEVs, and delaying those deliveries until January 2024, gives manufacturers a head start on meeting this new 2024 requirement.

The SMMT, being the industry body, is on the side of the manufacturers in this. This is likely why the SMMT’s most recent market report is trying to come up with diversionary explanations for why BEV shares are currently down YoY. They say “last November [2022] was atypical with significant deliveries following supply chain disruptions.” Sorry SMMT, but that’s not an accurate account.

I would expect even Tesla to have some degree of delivery hold-back in the UK for the remainder of 2023. Why? Because there will be a ZEV credits trading scheme whereby Tesla, Polestar, and other manufacturers that are ahead of the curve, can make money from the laggard manufacturers. If Tesla wants to meet particular 2023 global year-end delivery targets, they will more likely try to do that via other European markets and elsewhere.

The other manufacturers whose UK sales balance is already relatively BEV-heavy include: Porsche, MG, BMW, Audi, Mercedes-Benz, Cupra, and Volvo. All are already above or close to 20% BEV.

Those manufacturers and brands which are within reach of the 2024 requirement (with a bit of hard work) include the Korean brands, Volkswagen, Audi, most of the Stellantis brands, and perhaps Renault.

Nissan will need an almighty effort. Ford and the remaining Japanese brands have no chance, and will have to juggle the formula, and buy credits from others, and borrowing from their future selves. Not kidding, the political fudge allows deferred accounting, at least until the end of 2026.

Low volume brands (Ferrari, McLaren, etc) get a temporary pass, but they too will have to step up before the end of the decade. To learn more about the imminent UK ZEV scheme, there’s a useful overview by Phil Curry, over at Autovista24.

What we can predict is that the overall market will see BEVs at least at 22% share in 2024. The mandate thereafter steadily ramps up, to 38% by 2027, and then more steeply, to 80% by 2030.

I expect the transition could happen a lot faster than this planned timeline, unless UK political actors block the import of great-value Chinese BEVs from the likes of Tesla, MG and BYD, which they might, depending on pressure from the Neo-Cons and Cold Warriors.

What are your thoughts on the UK’s transition to EVs? Please join in the discussion below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica's Comment Policy