Spreading Like Wildfire: An Interest In Making Electric Power Public

Originally published at ILSR.org.

By Lilli Ambort

On the morning of November 8th, 2019, a live wire broke free of its grip on a 99-year-old electrical tower, sparking one of the most deadly and destructive wildfires in California’s history. Iris Natividad was away from home when her partner Andrew Downer told her over the phone that the fire was a mile away from their house. There was no one to evacuate Mr. Downer, a 54-year-old amputee, and he told Ms. Natividad, “Today might be a good day to die.” Mr. Downer and his service dog were among the 85 people killed by the Camp Fire that engulfed Paradise, California, as a result of negligence by the electric utility, Pacific Gas & Electric (PG&E).

Deadly fires and multi-day blackouts have become the reality for California’s residents, due to a combination of climate change induced weather and PG&E’s prioritization of profit over people. Investigations show that utility mismanagement and prioritizing shareholder returns over maintenance budgets increased the risk from wildfires and led to the utility’s bankruptcy in late 2019.

In response to the revelations of utility management malfeasance, California’s legislators and community members are calling for a public takeover of the electric utility. Governor Gavin Newsom has called the bankruptcy filing a “Godsend” for the opportunity to create a safer public utility that serves the people. The bankruptcy of PG&E presents a unique opportunity to buy grid infrastructure and redirect investment into public goods, like resilient solar and battery storage, rather than private profits.

California electric customers aren’t alone in hoping to be better served by public ownership of utilities. More than 2,000 public utilities already provide power to about 45 million people. Despite the time and money required for a public takeover (also called “municipalization”), several communities across the U.S. are taking this step toward local energy self-reliance.

The Future of Public Power in US Communities

San Francisco, California

In September of 2019, ready to address public safety power shut-offs and the utility’s wildfire risk mismanagement, San Francisco offered 2.5 billion dollars to purchase grid assets that serve the city and establish a public utility. PG&E rejected the offer, saying that it undervalued the assets and selling them was not in the best interest of the company. Despite this setback, San Francisco’s officials plan to continue pursuing a deal with PG&E.

Pueblo, Colorado

When Xcel Energy announced that the Comanche Power Generating station in Pueblo would be shutting down two of the plant’s boilers by 2025, residents were reminded of the steel-mill layoffs and closures in the late 1970s and 80s that led to the loss of 8,000 jobs. The town has never fully recovered from the economic blow of the layoffs, but today, Pueblo offers hope to other cities facing coal plant closures. With increasing demand for renewable energy, a factory serving Vestas, a Danish wind turbine company, is experiencing a boom in business. As Pueblo transitions away from a fossil fuel economy, Pueblo’s citizens are hoping that municipalizing their electric grid will allow them to use locally generated wind power.

Halfway through their contract with Black Hills Energy, Pueblo’s city council commissioned a study on the feasibility of forming a public utility. The study found that the city would save about 10 to 12% and benefit from lower rates, local economic benefits, and local control over key energy decisions. The city council approved a second resolution to move forward with phase two of the study, this time investigating the regulatory filings needed to proceed with municipalization. The vote to continue the municipalization effort must occur before August 10th, 2020, and will likely occur in Spring of 2020.

Chicago, Illinois

Commonwealth Edison (ComEd) is facing two federal grand jury subpoenas requesting records on the company’s lobbying efforts. A crime probe found payments looping through the company’s network of consultants to avoid lobbying disclosure rules. In addition, customers are likely to see rate hikes as ComEd plans to embark on another multibillion dollar capital spending project. The “formula rate” system, enacted nine years ago, guarantees ComEd a specified return on all infrastructure investments, taking away regulators’ authority over rates. Annual capital spending has doubled since the formula rates were enacted and customers have seen their electricity delivery rates climb 35% since 2011. However, Chicagoans are tired of their money going to shareholders and lobbying efforts, with supporters of municipalization in Chicago calling for the utility to be bought out and turned into a public agency.

The expiration of the contract between ComEd and the City of Chicago has been called a “once-in-a-generation” opportunity to reevaluate the relationship, with the franchise contract last renewed in 1992. The City of Chicago is exploring the possibility of ending its contract with Commonwealth Edison after 22 aldermen introduced an order directing the city council to conduct a feasibility study. One alderman stated that he hopes municipalization will speed up decarbonization and ensure better rates. The contract expires on December 31st, 2020, and according to the current contract, the city must notify Commonwealth Edison one year prior to municipalization.

Pittsburg, Kansas

The city council of Pittsburg, Kansas, commissioned a feasibility study on municipalization, citing the costly nature of its extended contracts with monopoly utility Evergy. The study found that the city’s return on investment from forming a municipal electric utility would be 1.75 times greater than the cost of debt incurred, making municipalization highly compelling. The council is currently in negotiations with Evergy, with a decision on whether to municipalize to be made within a year. The state of Kansas is friendly to municipalized electricity, with 118 communities already using public power.

In response to calls for municipalization, Evergy commissioned its own feasibility report that claimed a public takeover would cost customers more than 100 million dollars over 20 years due to acquisition costs, legal fees, startup costs, and higher rates. Utilities frequently inflate costs and diminish the feasibility of municipalization to maintain control of their market share. In this case, the $100 million price tag for municipalization in Evergy’s study is based on the high cost scenario of municipalization, not the most likely scenario.

Maine

A new billing system instituted in late 2017 by Central Maine Power (CMP), a subsidiary of Avangrid and Iberdola, left 100,000 customers with billing errors. Thousands simply stopped receiving bills and others had to deal with incorrect billing amounts. The billing system overhaul effort was woefully understaffed, meaning customers had to go longer without a resolution for their bill disputes. However, billing is not the only department of CMP that is short staffed. Maintenance crews are facing an average of 20 hours of overtime and customers face hours-long wait times to file complaints with customer service. In 2019, CMP ranked dead last in business customer satisfaction among 85 American utilities ranked by J.D. Power. The company’s reputation has been degraded in the public opinion, and rate hikes and customer dissatisfaction have lawmakers calling for the public takeover of CMP — and Emera Maine, the other investor-owned utility in the state.

Politicians have been touring the state discussing the benefits of municipalization, emphasizing lower rates, economic benefits, and the ability to integrate green technology into energy production. Politicians are ready to release a bill to municipalize Maine’s electricity closely following the release of a feasibility report that was due in February 2020.

Santa Fe, New Mexico

Decorah, Iowa

As much as 100 million dollars in county-wide energy spending is funneled every year out of the small community of Decorah, Iowa to an investor-owned utility in Madison, Wisconsin. The feasibility study on forming a municipal utility in Decorah showed that customers could save up to 30% on power costs, with more opportunities for clean energy and investment in the community. However, when the municipalization of the electric utility came to a vote, the ballot measure fell short by three votes, with Alliant Energy outspending the “vote yes” group, Decorah Power, by a four-to-one margin. Despite the loss, Decorah Power hopes to go back to the ballot box after a four year waiting period. In the meantime, activists have not lost sight of a future with locally controlled power.

Listen to two Local Energy Rules podcasts with leaders from the Decorah Power movement: In October 2017 as the campaign heated up and in April 2018 just before the vote.

The Long Road Ahead

Boulder, Colorado was one of the first communities in the US to begin the process of municipalization over clean energy, having voted to proceed with the public takeover in 2011. The city considered four separate scenarios based on cost of acquisition and energy sourcing, with only the most expensive scenario coming in at a loss. In the base case, or the most likely scenario, Boulder would enjoy 13 million dollars in savings over 5 years, and more than 100 million dollars over 10 years after expenses and loan repayment.

Despite a substantial effort from incumbent electric utility Xcel Energy to prevent municipalization, the City of Boulder has stuck to its decision and remains on track to form a municipal utility. A firm decision is expected via a referendum in 2020 or 2021. Although Xcel Energy has been procuring more energy from renewable sources, the question of municipalization for Boulder has become about alignment with their goals and values, including the desire for local generation and resilience. As Jonathan Koehn, Boulder’s Regional Sustainability Director, said of the move toward municipalization, “…I think we are seeing that the conversation shifts to not, ‘Are renewables viable and should that be the direction we go?’ but, ‘How do you do it, and what’s the right ownership structure?’…” Boulder’s fight to uproot an entrenched private utility has been long, but they inspire many other communities to do the same.

Related Resources

- ILSR’s Energy Research Hot Spot: Taking Over Your Utility

- Other ILSR stories about municipalization

Steps to Municipalize an Electric Utility

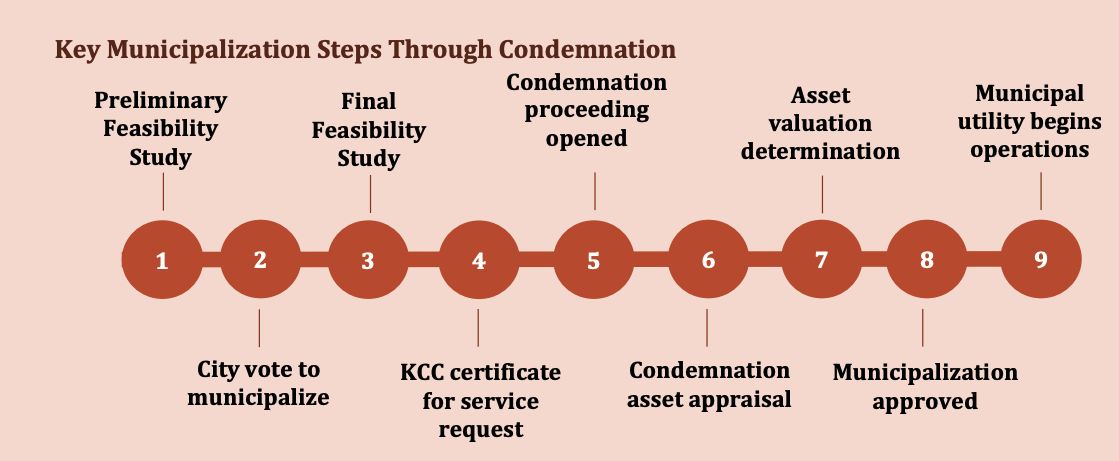

Engaging and uprooting corporate interests makes the process of municipalization complicated quickly. An outline of the basic process, by the American Public Power Association, follows as:

- Start with a lead person or organization

- Feasibility study to determine potential savings

- Legal analysis to ensure there are no insurmountable legal impediments

- Study of the value of the electric distribution system

- Community education to keep citizens informed and counter private utility opposition

- Referendum to authorize establishing a public utility

- Price negotiation for a purchase of the private utility’s facilities, if they refuse to sell the may consider condemnation

OR

- Public service commission proceedings as some states need a public service commissions’ authority to purchase an electric distribution system

- Evaluation of financing alternatives to acquire and establish operations

- Prepare to begin operations

This article originally posted at ilsr.org. For timely updates, follow John Farrell on Twitter, our energy work on Facebook, or sign up to get the Energy Democracy weekly update.

Featured photo by Jose Pontes, CleanTechnica

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.