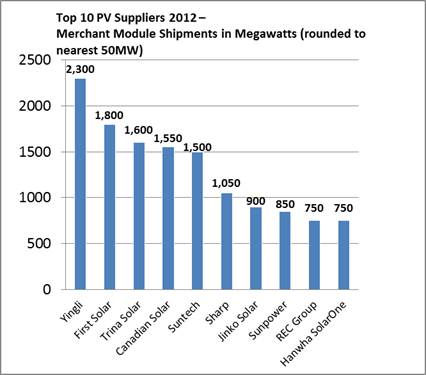

Top 10 Solar Module Manufacturers (IHS Report)

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Reposted from Solar Love (with minor changes):

Market research firm IHS has released a report on the top solar module manufacturers of 2012. Regular readers may think this sounds familiar. If so, it’s probably because you’re remembering the Solarbuzz report on the top solar module manufacturers of 2012 that we reported on in February. For the most part, the IHS report agrees with the Solarbuzz report’s top 10 list. However, there are some differences.

As with Solarbuzz, IHS reports that the top 2 solar module manufacturers of 2012 were Yingli (#1) and First Solar (#2). However, in the Solarbuzz report, Suntech came in at #3, while it came in at #5 in the IHS one. Compared to the Solarbuzz report, Trina Solar climbs from #4 to #3, while Canadian Solar climbs from #5 to #4.

Sharp Solar is #6 on both lists, Jinko Solar is #7, and Hanwha SolarOne is #10. However, Solarbuzz had JA Solar at #8 and SunPower at #9, while IHS has SunPower at #8 and REC Solar at #9.

For the rest of this article, I’ll just delve further into the IHS report.

Solar Power World had a good summary of the key movements in the top 10:

“In a year that proved very challenging for the entire PV industry, Yingli managed to increase its merchant shipment volumes by 43 percent year-over-year to leapfrog Suntech as well as U.S.-based First Solar, the two largest suppliers of 2011. First Solar managed to defend its position as the No. 2 module manufacturer, while Suntech lost significant ground and was displaced to fifth position behind Trina Solar and Canadian Solar. REC, the only Top 10 supplier headquartered in Europe, grew faster than most of its Chinese competitors in 2012. Increasing its module shipments by 31 percent year-over-year to 757 megawatts (MW), REC strengthened its position as a leading player in a highly competitive environment.”

I would think that more of the manufacturers not in the top 10 would have fallen by the wayside in 2012, but according to IHS, the top 10 in 2012 accounted for 40% of market share, while the top 10 in 2011 accounted for 46% of market share. IHS reports that the companies that took market share from the top 10 were other large manufacturers that had scaled up operations despite the global solar module oversupply and diving solar module prices.

Also, Japanese module manufacturers benefited from the solar boom resulting from the country’s aggressive feed-in tariffs, as well as the country’s strong preference for Japanese-made products (especially when it comes to technology).

“Japanese suppliers Solar Frontier and Kyocera expanded output and shipments massively in 2012, and both benefited from the current boom in Japan,” Stefan de Haan, principal analyst for solar at IHS, said. “Solar Frontier climbed from No. 14 in 2011 to 11th place in 2012, while Kyocera rose from No. 17 to No. 12.”

Nonetheless, some top 10 companies did grow market share.

“Canadian Solar, as well as Jinko Solar and Hanwha SolarOne were the only Top 10 companies that managed to grow merchant module shipments at a double-digit rate in 2012—in addition to Yingli and REC, of course,” de Haan said. “SunPower and Trina grew at a slower pace, while Suntech, First Solar and Sharp from Japan saw declining shipment volumes. Global PV end markets increased by a robust 14 percent in 2012, so on average the leading module suppliers effectively lost some ground.”

And a handful of Chinese solar module manufacturers — Renesola, Astronergy, Hareon Solar, and JA Solar — increased output considerably, by over 200 MW each.

A trend in the solar market that has been discussed repeatedly is that the market is becoming more global, expanding beyond some key European markets that dominated demand to markets around the globe. From Solar Power World:

“Yingli generated 24 percent of its 2012 revenue in China. Jinko is another winner in this market, shipping approximately 400 MW to China alone in 2012 while also building up a strong presence in South Africa. For its part, Canadian Solar generated 26 percent of 2012 sales in the U.S. market and is also one of the strongest imported brands in Japan. Leading U.S. supplier First Solar, on the other hand, is anchoring itself to the Latin America market with the acquisition of a Chilean-based developer and its portfolio. These are a few examples highlighting the importance of timely and appropriate reaction for PV suppliers in a rapidly changing environment.”

Lastly, if you care much about the countries in which the top 10 manufacturers are based, here’s the breakdown:

- Yingli — China

- First Solar — US

- Trina Solar — China

- Canadian Solar — China

- Suntech — China

- Sharp Solar — Japan

- Jinko Solar — China

- SunPower — US

- REC Group — Norway

- Hanwha SolarOne — China

Any more thoughts?

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica's Comment Policy