In 2023, Indian EV Market Faced A Bumpy Road But Forged Ahead

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

2023 has been an interesting year for the Indian EV market. There have been hiccups along the way, but the overall market has continued to forge ahead. Like what we did for the year 2022, time to take stock of things and look at the outlook for 2024.

Again, similar to the 2022 exercise, all the data here has been sourced by the Indian central (federal) dashboard (Vahan portal). The portal aggregates data from all the RTO (Regional Transport Offices) where vehicles are registered. However, not all states have onboarded onto Vahan. Currently, of the 36 States and Union Territories, 34 have onboarded. And of the 1428 RTOs, 1341 are registered with Vahan. The data that is used accounts for 90–95% of all vehicle sales in India. Hence we will not be looking at absolute figures as they are not complete, but we can look at the share of electric vehicles in each segment and market share of various brands. As these are proportional data, they would be more closer to actual figures and we can take the data from a directional sense.

We will divide the Indian auto segment into four broad segments as is the norm in the automotive media here. They are:

- Two wheelers — These include all powered two wheeled vehicles which have a maximum speed above 25 kms per hour. They are broadly of two categories — Scooters and Motorcycles.

- Three wheelers — These are three wheeled vehicles (Tuk Tuks, Rickshaws) and include both used for moving people and goods.

- Passenger vehicles — These primarily include cars and other vehicles used for personal mobility with more than 3 wheels. For practical purposes, we can assume this to be equivalent to cars.

- Commercial vehicles — These include a wide range of vehicles from large trucks, buses to mini vans and smaller good carriers.

Electric Two-wheelers

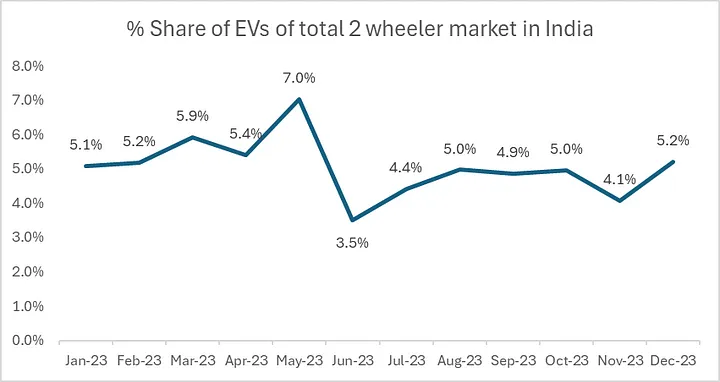

Electric two-wheelers had a roller coaster of a ride in 2023. The share of EVs increased slightly from 4.1% in 2022 to 5% in 2023. Sales as tracked in Vahan portal increased from 601,030 in 2022 to 854,892 in 2023 (42.2% increase year on year). This is in comparison to an 11.2% increase in the overall two-wheeler market in India from 14.48 million in 2022 to 17.01 million vehicles in 2023.

In the beginning, there were expectations that share of EVs within the segment would reach double digits (10%+) by the end of the year. However, the segment hit a speed bump in the middle of the year when the federal government revised the sales incentive provided to electric two-wheelers (called the FAME II scheme).

The government revised the FAME-II subsidy amount to ₹10,000 ($121) per kWh as against the earlier amount of ₹15,000 ($182) per kWh. It also capped incentives on e-2Ws at 15% of the ex-factory price of vehicles from 40% earlier. Most electric scooters currently selling have a battery capacity of around 2.5 to 3.5 kWh, retailing between ₹120,000 to ₹150,000 ($1,450 to $,1800). This resulted in reduction in subsidy of ₹20,000 to ₹25000 ($250–$300).

The change in subsidy also impacted launch plans of major players. Ola Electric, the current market leader, initially planned to launch its most affordable model, the S1 Air, at a price of ₹84,999 (~$1,000), comparable in price to the top selling ICE two-wheeler model from Honda Motors (the Honda Activa). However, with the change in subsidy, Ola Electric revised its S1 Air price to ₹119,000 ($ 1450), significantly higher than the original price.

As can be seen in the chart above, share of EV sales was trending at 5%+ in the beginning of the year, tanked to 3.5% in June post subsidy revision, and took the rest of the year to reach back to the previous levels.

From a brand share perspective, the market is consolidating towards 4 major players from 5–10 players with small market shares. The top 4 brands now account for 71% of the total sales, up from 62% in 2022. Ola Electric remains the market leader with 31% market share, followed by TVS at 19%, Ather Energy at 12%, and Bajaj at 9%. [For people not familiar with these brands, Ola Electric and Ather Energy are pure electric startups while Bajaj and TVS are established OEMs with significant ICE market shares.]

Outlook for 2024

Forecasting for 2024 is going to be tricky given the uncertainty on the FAME II subsidy front. The original subsidy mandate was till March 2024, and there are conflicting reports on the possibility of extension or not of the subsidy beyond that. We should get clarity on this in the annual budget in February 2024.

Now on the brand front, we have Ola Electric launching its next set of affordable S1 X scooters with prices starting from ₹89,999 ($1,089) [assuming continuation of FAME II subsidy]. This is similar in price to the top selling ICE variant by Honda. Combined with other brands also looking at affordable models, along with the entry of Taiwanese EV pioneer Gogoro into Indian market, I expect EV share to steadily increase to 7–8% of the total 2-wheeler market and cross a million units in annual sales in 2024.

This is assuming continuation of the FAME II subsidy. However, if on the other hand we do see a reduction/termination in subsidy, then the EV share would behave similar to 2023, a drop in sales immediately post reduction and recovering to similar or slightly higher levels later in the year.

[There are news reports that the Japanese brand Honda will soon launch the EV version of its most popular ICE scooter, the Honda Activa, in 2024. However, I remain skeptical given that I have been seeing these news report for the last few years — 2019, 2021, 2022.]

Cars (Passenger Vehicles)

Cars (passenger vehicles or PVs for short) had a good year with regards to sales of EVs (BEVs). BEV share of total cars sold stood at 2.1%, nearly doubling from 1.1% in 2022. Sales tracked in the Vahaan portal increased from 45,885 in 2022 to 79,388 in 2023 (115% increase year on year), with the overall market growing from 3.46 million units in 2022 to 3.78 million units in 2023.

Tata Motors continues to be the dominant player in the EV space, accounting for 75% of all BEVs sold in 2023. In 2022, a majority of the BEV sales came from one model, the Tata Nexon EV. In 2023, we had the launch of the Tata Tiago EV, one of the most affordable EVs in the Indian market. With starting prices of ₹869,000 ($10,500), the model is cheaper than the average selling price ($12,500) of cars in India and it literally doubled the BEV monthly sales total. Today, with 3 BEV models, EVs account for 10% of Tata’s car sales in India.

We also now have significant contributions from two more brands. We have the Chinese–UK brand MG with its MG Comet EV, priced similar to Tata Tiago EV, raking in ~1,000 units of sales every month. Mahindra & Mahindra launched their first full fledged electric SUV, the XUV 400 (comparable to the Tata Nexon EV). Mahindra is able to rack up 500 sales every month.

Outlook for 2024

2024 is going to be an exciting year, with planned launches of multiple new BEV models across brands, including Korea’s Hyundai–Kia group, ICE market leader Maruti Suzuki (subsidiary of the Japanese brand Suzuki), and some Indian brands — Mahindra & Mahindra and Tata Motors.

However, except potentially Mahindra & Mahindra’s XUV 300 EV, most of these models will be at the premium end. As mentioned before, the average selling price of cars in India is around $12,500 and most of the cars will be priced ₹200,000 ($24,000) or higher. At nearly two times the average selling price, these models will not be needle movers in terms of EV adoption.

For me, Indian EV adoption for cars will still be driven by Tata Motors in 2024, too. In 2024, we have Tata Motors planning to launch Tata Punch EV, Tata Harrier EV, and Tata Curve EV. The Tata Punch EV will be the important model to look out for. The ICE variant is currently one of the top selling SUVs in India, and if we go by previous Tata Motors pricing, we can expect the Tata Punch EV to be priced between the Tata Tiago EV and Tata Nexon EV ($12,000 to $18,000), making it the most affordable electric SUV on the market.

With these launches, I would expect EV market share to steadily increase to 3–4% by the end of 2024.

Three-wheelers (Tuk Tuks, Rickshaws)

The sales of electric 3-wheelers have remained pretty steady, with 54.8% market share in 2023. This is nearly the same as 54% market share in 2022. As I explained last year, the market is fragmented with diesel, CNG (compressed natural gas), and electric variants. Other than Mahindra & Mahindra, the electric segment lacks innovative startups or established OEM brands. Most of the brands and models are low-speed rickshaws imported and assembled here. Hence, the adoption rate has plateaued. The ICE market leader in this segment is Bajaj Auto, which has nearly 60% share in the ICE segment. The company finally launched its first electric 3-wheeler in 2023 — albeit, available initially in 2 cities.

From two cities, Bajaj Auto has recently expanded into 10 cities in North India. Currently, Bajaj Auto has a market share of 2.2% of the electric 3-wheeler market, selling around 1000 units a month. By March of 2024, it plans to expand to 40 cities, before reaching 250 cities in FY-25. I expect the electric share of the 3-wheeler segment to finally grow towards 60%+ in 2024, significantly boosted by Bajaj’s entry into this space. We can also expect a significant market consolidation with Bajaj and Mahindra increasing their share.

Commercial Vehicles (CVs)

Commercial vehicles in India span a wide range of vehicular segments and include buses, heavy-duty trucks, light passenger and cargo vans, among others. Similar to global trends, the electrification of this segment is still in its infancy. Electric variants accounted for 0.53% of all CVs sold in 2023, nearly doubling from 0.29% in 2022.

Outlook for 2024

We can expect incremental increases in electric share of this segment. The two sub-segments where electrification will be relatively faster are buses and vans.

In buses, there are several government initiatives to phase out diesel buses from inter-city and intra-city transportation (including a joint US–India initiative to replace 10,000 buses). Given the public and federated nature across municipal, state, and federal governance, we can expect non-linear progress.

As far as the van segment, a lot of vehicles are primarily used for last-mile supply chain transport. Given the aggressive net zero targets of large retailers and with the planned launches of new models across brands, this segment will continue to be electrified.

Summary

2023 was an interesting year with regards to electrification of the Indian transport sector. The sector faced many challenges but has managed to overcome the same and maintain its momentum. 2024 will see electrification gain steady strength across segments. There is an outside chance that we might see the 2-wheeler segment break out into double-digit shares and cars move towards 5% share. We will circle back again next year to see how it turns out.

By Lakshmisha K S, Technology enthusiast, ex-management consultant and amateur economist, NITK-Surathkal, XLRI alumnus

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica's Comment Policy