The First Rule About ESG Is: You Don’t Talk About ESG

Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and/or follow us on Google News!

The movement to codify progressive environmental, social, and governance principles for businesses is gathering steam, with a particular emphasis on decarbonizing the global economy. Known as ESG for short, the movement has naturally encountered considerable opposition from fossil energy stakeholders and their allies in government, and now it appears that a game of ESG whack-a-mole is under way.

Let’s Talk About ESG

For those of you new to the topic, ESG is the latest evolution in modern business practices that support bottom-line aims with a focus on public image. Up through most of 20th century, for example, charitable giving was the hallmark of a profitable company seeking to burnish its reputation.

As the 2000s neared, the idea of simply tossing dollars at a project began to give way to the corporate social responsibility movement of the early 2000s, which emphasized community and employee engagement.

Nowadays, with the impacts of climate change coming into full force, human rights under threat, and extremist attacks rising here and abroad, corporate interests are facing a thundering herd of risk factors. The social responsibility movement still exists in some form, but the conversation now has turned to ESG as a more rigorous and measurable means of identifying and avoiding risks, particularly when the topic turns to decarbonization.

No, Let’s Not Talk About ESG

All else being equal, fans of free-market capitalism here in the US would be content to let the Titans of Business figure out their own risk management strategies. However, nothing is equal under the political environment of today. The leading lights of the Republican party, which used to tout itself as the business-friendly party, have turned around to threaten and harass banks and other financial firms that act in support of ESG investing guidelines.

CleanTechnica has been tracking some of the anti-ESG rhetoric and activities (see our coverage here) currently under way. So, when we received an invitation to a presentation with the real estate and clean tech venture capital firm Fifth Wall last month, we took them up on the offer.

In 2016 Fifth Wall began investing with a focus on real estate as “simultaneously the largest and least technologized industry in the world.” Last year the firm launched its first Climate Fund with $500 million at hand. Fifth Wall also crossed the CleanTechnica radar for its green hydrogen and hydrokinetic energy ventures earlier this year.

In the course of the presentation, Fifth Wall co-founder and Managing Partner Brendan Wallace touched on the influence of partisan rhetoric. He suggested that ESG advocates can turn off the noise machine and go about their business without engaging in an argument over principles.

It’s not quite that simple, but a similar line of thinking also popped up last Friday in a CNN article under the attention-grabbing headline, “ESG investing is dying. That’s not a bad thing.”

CNN reporter Nicole Goodkind cited the head of global research at the financial data provider Lipper, Robert Jenkins. He indicated that ESG is far from dying out. Instead, it is evolving from a niche practice into across-the-board applications.

“It’s actually going to fade a little bit from its marquee nature, it’s just going to be a part of sound business strategy and management,” Jenkins told CNN. “They’re just going to be put alongside all the other fundamental analytics that we’re so used to hearing about, your earnings-per-share and your GAAP accounting. ESG ratings will just become part of that toolkit for investment managers.”

“ESG won’t be as glamorous as it was before, but it won’t be a politically explosive term either,” Goodkind concluded.

So, Let’s Talk About Decarbonization

The Fifth Wall dinner led to an opportunity to speak one-on-one with Greg Smithies, another Partner and the co-head of Fifth Wall’s Climate Technology Investment Team.

“Buildings do account for about 40% of the [greenhouse gas emissions] problem but they only attract about 6% of the solution dollars,” Smithies told CleanTechnica.

Smithies took note of recent technology improvements in heat pumps and induction cooktops, which enable individuals to invest in solutions for their own homes. Solar-plus-storage is another avenue to pursue, though changing up cooktops is probably more accessible for most households.

On the big-picture end, Smithies described how decarbonizing the built environment is “incredibly complicated” compared to decarbonizing cars. In addition to the carbon footprint of building materials, the mountains of waste generated by buildings also come into play. According to Smithies’s estimate, buildings account for 60% of the world’s waste.

On the flip side, all this complexity opens up a wide variety of decarbonization opportunities.

Smithies told CleanTechnica that Fifth Wall considers everything from clean concrete and steel to cross-laminated timber, along with alternative construction methods including pre-fab, modular and 3-D printing, and energy efficiency strategies for existing buildings.

“We would like to put up more buildings faster and cheaper,” Smithies said, observing that the US is already 2 million buildings behind demand.

ESG By Any Other Name

Smithies closed out our conversation with some encouraging thoughts for anyone who is feeling overwhelmed by the looming climate crisis.

He observed that the decarbonization technology wheel has been moving almost imperceptibly for decades, hampered by competition by low cost fossil fuels. Now that the cost barrier is breaking, the floodgates are finally open.

“The US economy is like a massive oil tanker. The front nose of it has been on the green train for 50 years but we’re not going to start doing anything until the whole tanker moves,” he said.

“The opportunity in the last 10 years is that many of these technologies have come down the cost curve so far you can sell them to a climate-denying CFO,” he emphasized. “The companies are going to buy it because it makes economic sense.”

As examples, Smithies cited Source Water’s water harvesting technology and the EV battery recycling firm Ascend Elements, two companies in the Fifth Wall portfolio.

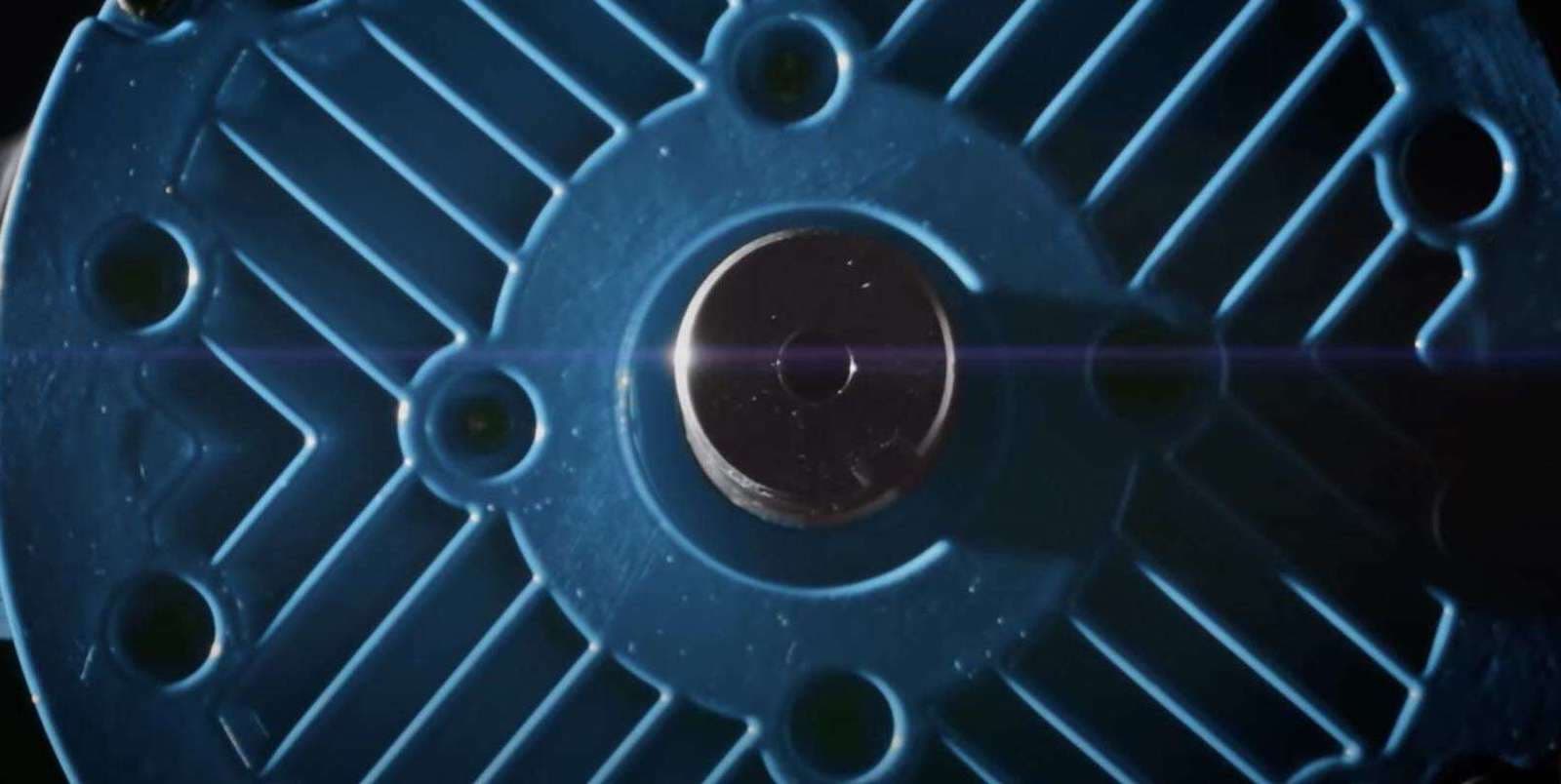

Another portfolio company to keep an eye on is Turntide Technologies, which has come up with a next-generation version of the ubiquitous electric motor commonly used in HVAC systems and other building equipment. Turntide found its way onto the CleanTechnica radar in 2021 with its energy efficient Smart Motor System.

Turntide has been rather busy since then. In January the company announced that it is applying its electrification solution to hard-to-decarbonize vehicles including construction and agricultural machines trains, and shipping equipment.

“These vehicles present greater sustainability challenges than passenger vehicles because of their heavy-duty loads, work cycles, and vibration,” Turntide noted, while also pointing out that its electrification solution will “help its customers transform commercial and industrial vehicles from gas and diesel engines to clean, quiet battery electric machines — a significant step towards achieving global net-zero goals.”

ESG by any other name…

No more Trainwreck Twitter for me! Find me on Spoutible: @TinaMCasey or LinkedIn @TinaMCasey or Mastodon @Casey or Post: @tinamcasey

Photo: Electric motor courtesy of Turntide Technologies.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica's Comment Policy