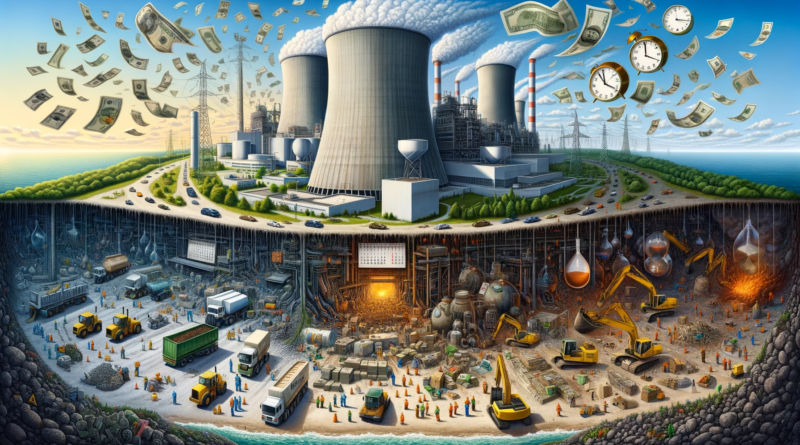

US Nuclear Site Cleanup Underfunded By Up To $70 Billion

Support CleanTechnica's work through a Substack subscription or on Stripe.

Headlines out of the UK are pointing out the horrible state of affairs for nuclear generation decommissioning after a committee of Members of Parliament that the UK’s Nuclear Decommissioning Authority really doesn’t have a handle on the 17 sites, their costs, or the vendors they selected for cleanup. They are currently projecting $177 billion and 120 years for the full decommissioning, over $1 billion per site. Some of this is due to botched procurement, with two different cleanup vendors stripped of their contracts.

Certainly the UK cleanup is a fustercluck of epic proportions, equivalent in fiscal sense to building Hinkley. That new reactor, billions and years over budget and schedule, required a commitment for 35 years to pay $150/MWh for every MWh they generated, at a time when onshore wind and solar in the UK are at or under $50/MWh and offshore wind is under $100/MWh.

Some US commenters were feeling chuffed, although that’s not a term they would use, that the US was handling things so much better. But the USA isn’t far behind the UK in problems, it just isn’t as public.

Per the World Nuclear Association:

In the USA, utilities are collecting 0.1 to 0.2 cents/kWh to fund decommissioning. They must then report regularly to the NRC on the status of their decommissioning funds. About two-thirds of the total estimated cost of decommissioning all US nuclear power reactors has already been collected, leaving a liability of about $9 billion to be covered over the remaining operating lives of about 100 reactors (on the basis of an average of $320 million per unit). NRC data for the end of 2018 indicated that there was a combined total of $64.7 billion held in the decommissioning trust funds covering the 119 operational and retired US nuclear power reactors.

An OECD Nuclear Energy Agency survey published in 2016 reported US dollar (2013) costs in response to a wide survey. For US reactors the expected total decommissioning costs range from $544 to $821 million; for units over 1100 MWe the costs ranged from $0.46 to $0.73 million per MWe, for units half that size, costs ranged from $1.07 to $1.22 million per MWe. For Finland’s Loviisa (2 x 502 MWe) the estimate was €326 million. For a Swiss 1000 MWe PWR the detailed estimate amounts to CHF 663 million (€617 million). In Slovakia, a detailed case study showed a total cost of €1.14 billion to decommission Bohunice V1 (2 x 440 MWe) and dismantle it by 2025.

[Brief aside: I love the World Nuclear Association, because they are actually honest and report details that contradict their mission. I cite them on Germany’s wholesale electricity prices, which they freely admit are among the lowest in Europe as that country ramps up renewables rapidly and dumps nuclear. They aren’t just a lobbying organization, although they are an industry-funded lobbying association. Unlike the equivalent oil and gas organizations, they seem compelled to be honest and complete, perhaps because being honest and complete usually isn’t so disgustingly horrific for them, just simply bad.]

Back to the thread. The US has collected a bunch of money from operating reactors into a cleanup fund that they acknowledge is underfunded to the tune of billions already. But the industry estimates show that they are collecting under half of what it will actually take to decommission the sites.

There are about 100 reactors in the United States. Assuming they collect the $320 million per reactor (they won’t, as reactors are closing prematurely), they would have a fund of $32 billion. But they need a fund of closer to $70 billion, and they are short regardless. So the US fleet cleanup is going to cost the taxpayer probably closer to an additional $40 billion, if it all goes according to the estimates.

Note that the UK and Slovakia examples show that it usually doesn’t, just as building new nuclear never seems to come in on time or budget. The reality is going to be closer to the European and Slovakian costs, so let’s assume a billion per reactor as a reasonable number.

The US will have maybe $30 billion. They’ll need $100 billion. Yeah, $70 billion is the more reasonable number.

“A billion here, a billion there, pretty soon you’re talking real money.”

– US Senator Everett McKinley Dirksen

Of course, this is on top of the $1.6 billion annual tax breaks nuclear plants in the US get, the $10 billion liability insurance cap with the taxpayer holding the bill should a Fukushima-scale disaster occur and the state-level boondoggles like the $1.1 billion Ohio subsidy that came with a side helping of $60 million in bribes.

Nuclear power is going to be the gift that keeps on returning fiscal dividends for a century.

That’s why Brookfield bought the bankrupt Toshiba Westinghouse division, for the long-term, guaranteed decommissioning revenue. SNC Lavalin bought Canada’s CANDU for the same reason, although I’m sure they are at the trough on the Canadian SMR idiocy too.

As a note, the nuclear industry’s cleanup being thrown on the taxpayers’ back is a drop in the bucket compared to the cleanup for coal, oil, and gas extraction and refinement, the majority of which will be funded by taxpayers. In the past, I reported that Alberta’s oil and gas cleanup bill will be $200 billion more than the amount they have set aside. That’s one Canadian province, albeit the worst of the Canadian ones. Doubling that for the rest of the country suggests a $400 billion shortfall for the country around oil and gas. The standard guideline is multiply the Canadian number by 10 for the US, so there’s probably in the range of $4 trillion unfunded oil and gas cleanup in the US. Certainly the nuclear set-aside doesn’t give any comfort that the fossil fuel industry is doing any better. Being $70 billion short on the nuclear cleanup starts to look like chump change when you consider potentially $4 trillion for oil and gas.

This isn’t exactly a secret. Nuclear projects always go over budget and over schedule, and there is exactly zero reason to believe decommissioning estimates provided by the industry. So why have jurisdictions been building more nuclear plants, whether at the egregious but at least honest costs of Hinkley, or the massively underestimated but increasingly obvious costs of the Virgil C. Summer and Vogtle sites? Three reasons.

The first is the magic of net present value. That calculates the value of future dollars today given inflation. Just as a thousand bucks bought a lot more in 1990 than it does today, in 2050 it will buy a lot less than it does today. That means that liabilities that will be incurred decades in the future approach zero cost in today’s cost benefit analysis. Can you say generational inequity?

The second is ideology. When really blatantly obvious economic sense gets thrown out the window, you start looking around for irrationality or graft. A lot of conservatives really hate onshore wind because it spoils the views from their manses (UK) or ranches (US) or country estates (Oz). They also think of wind and solar as inadequate hippy shit. They think nuclear is the answer. These are opinions that they formed in the 1970s or perhaps the 1980s, but conservatives have a stronger tendency to not let empirical reality change their mind. So Hinkley, Vogtle, and Summer are a triumph of ideology over reality.

The third is graft. When we start talking about $10 billion or more to build a plant, billions in subsidies, and another billion to take the thing apart, a lot of people start rubbing their hands together and figuring out who they have to bribe now to get a big payoff later. The entire regulatory structure in the two states that had nuclear plants in construction until recently when one was finally put out of the state’s fiscal misery were both structured so that no matter how much the utility spent, it was guaranteed a set profit. If they built a $15 billion nuclear plant, they made a lot of profit off of the rate payers. If they built $2 billion worth of wind and solar instead, they made a lot less money off of the rate payers. It’s dumb as a box of hammers, but it’s part of the reason a lot of utilities love nuclear, and coal-generation carbon capture schemes to boot. They are licenses to print money.

Outside of China, where they have trained resources who can build nuclear plants who would be mediocre at building wind and solar (which they are building a lot more of) and nuclear plants will displace coal plants, it doesn’t make a lot of sense to build new nuclear. The looming decommissioning debacle is just the icing on the cake.

Wind and solar have proven themselves to be vastly cheaper, completely reliable on grids, and easy to integrate in very large amounts. Their decommissioning costs are trivial. That’s yet another reason why nuclear is dead, but pretending it’s not.

Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Sign up for CleanTechnica's Weekly Substack for Zach and Scott's in-depth analyses and high level summaries, sign up for our daily newsletter, and follow us on Google News!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one on top stories of the week if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica's Comment Policy