Solar Power Booming In Japan

Originally published on Energy Post.

By Rudolf ten Hoedt

A first gold rush driven by generous subsidies led to an uncontrolled boom in solar power projects in Japan, of which, however, only a very small percentage actually got built. Now, however, the government has taken charge and serious developers are entering the market. The liberalisation of the Japanese retail market in 2016 is expected to give another boost to solar power, as consumers will likely drive demand for renewable energy. The Japanese government and the big utilities, however, are hedging their bets: they are not prepared to let go off nuclear power anytime soon. Rudolf ten Hoedt reports from Kagoshima, Japan, home to the largest new solar project in Japan.

In April, Japan published the first update of its Basic Energy Plan since the 2011 nuclear Fukushima collapse. The plan sets policy for the Japanese power sector for two decades. It is updated every three years. The latest revision runs with the hare and hunts with the hounds. Prime Minister Shinzo Abe upholds nuclear power as “an important base-load electricity source” while at the same time calling for expanded use of renewable energy.

The new energy policy tries to please those that are concerned with Japan’s energy security and fossil import dependence and the nuclear lobby which exploits this vulnerability, but is also acknowledges the anti-nuclear sentiment in the country by giving a boost to green energy. Most of the plan is rather vague. It does not contain clear targets for nuclear energy, although it does express the aim to push renewables over the 20% threshold by 2030 (of total electricity production). Japanese newspapers quoted the influential Chief Cabinet Secretary Yoshihide Suga AS saying: “For the next three years, we will make (the development) of renewable energy a top priority.” This will certainly apply to solar power, which is already booming in Japan.

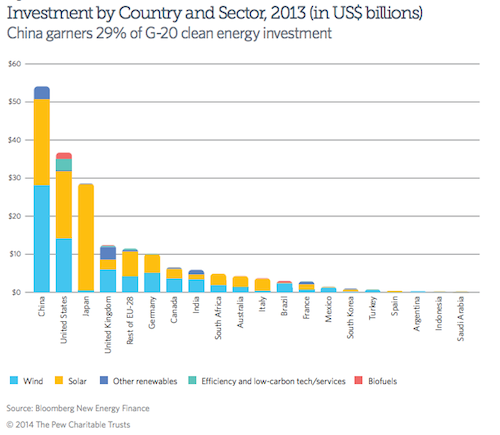

According to recent research from Bloomberg New Energy Finance carried out for Pew Charitable Trust, last year Japan invested more than any other country in solar energy. See the chart below.

For Japan, solar obviously has priority over wind power. 6.7 GW of solar capacity was approved in Japan for the feed-in-tariff (FIT) scheme in 2013. Almost half of this was utility-scale solar.

This year, Japan is even expected to install over 10 GW of solar power, with more than half of this being utility-scale solar. The boom in utility scale solar got started by an FIT- program introduced in 2012 by the Japanese government. Under this program, regional utilities have to buy power from solar and other renewable energy producers for non-household use at pre-set prices for a period of 20 years.

When the program was first introduced, it started a gold rush. “In the beginning, there were many developers with a low level of sophistication”, says Patricia Bader-Johnston of Thurlestone Capital, a renewable energy developer that has funded over 500 MW of solar and off-shore wind projects around the globe. “Everybody who had a claim on land applied for FIT pre-purchase agreements.”

Squeezed out

But bringing all these gigawatts from large-scale projects on stream is another story. Of the large volume of FIT-approvals, only a fraction has so far been actually developed. “Only 400 MW of (utility-scale) solar energy had actually been installed after the first year (2012-2013) of development activity”, Bader-Johnston notes.

Ichiro Ikeda, General Manager of the Solar Marketing Division of electronics multinational Kyocera, confirms this picture.“There have been cases in which construction is delayed for projects which were approved with feed-in-tariffs rates”, he says. According to Ikeda, delays are typically due to three reasons. “First, costs turn out to be higher than expected because projects are planned at sites with difficult land conditions, such as in mountainous or forested areas. Secondly, government approvals to utilize land zoned for agriculture or forest for solar power projects have fallen behind. Thirdly, the project cannot be financed or does not pass screening by financial institutions.”

Another reason for delays is that Japanese utilities are often not very keen to connect utility-scale solar plants to the grid, says Whitney Rich, executive advisor of Hergo Sun Japan, the Japanese affiliate of an Italian oil servicing company that has been active in maintenance of renewables sites for 20 years. The Italians came to in Japan 2012, where they now have 10.4 MW of solar capacity under construction and another 90 MW in the pipeline. “Costs to get connected to the grid are very high and it can take 3 to 4 years (to get connected).” As a result, says Rich, “small developers are being squeezed out.”

But things are getting better. The number of projects that actually get connected is rising fast, industry sources tell Energy Post. The government is making efforts now to clean up the debris of inactive pre-purchase agreements that have clogged up the system. This clean-up plus a recent decrease of the FIT rate – which was lowered from 42 JPY in 2012 and 38 JPY per kWh in 2013 to 32 JPY (about €0.22) per KWh now (which is still one of the highest rates worldwide), has started a shakeout among developers, says Rich. “Government has cut several hundreds of projects this month and will do so again in August. With an FIT of 32 JPY, you really have to know what you are doing. Now more professional developers are coming in.”

Kyocera is undoubtedly a professional developer, with deep pockets and enough patience to get connected to the grid. The multinational has been supplying solar power generating systems outside Japan for many years, at more than 30 locations in Asia, the United States and Europe, during times when large scale solar development at home did not stand a chance against the powerful domestic nuclear lobby.

Volcanic sand

On the Island of Kyushu, Kyocera has just built Japan’s biggest solar plant on a flat landfill site without a tree in sight, skipping problems with mountainous or agricultural terrain. The selected spot has other challenges, though. It stretches right into the salt waters of the East China Sea and is staring the 1400 m high Sakurajima volcano in the face. The new 70 MW plant, called Kagoshima Nanatsujima, is as large as 1.27 million m2 (equal to 175 UEFA football fields) and is situated less than 10 kilometers south of the coastal town of Kagoshima.

The city is overlooked by Sakurajima-san across a very narrow passage of Kagoshima Bay. Fine black volcanic sand can be found in every flower bed and crack in the pavement. The permanent white plume rising from the volcano’s cone regularly transforms into a light brown smog that is usually blown away to the North. In the event nature changes plans and the wind blows south during a more serious outburst, the 290,000 Kyocera panels on the nearby solar plant are supposed to withstand the ashes. A 200 ton pool of water and mobile pressurized water cannons are on standby to conduct emergency cleaning operations. The owners, who invested 27 billion Japanese yen (about €192 million) in the facility, installed 140 invertersand 1,260 monitors, manufactured by German market leader SMA, which are designed to weather hostile conditions.

Kagoshima Nanatsujima has been in operation since October 2013 and will produce 78 MWh/y. The owners say they sell all generated electricity to Kyushu Electric, the utility that controls 90% of the market on the island and which used to be heavily reliant on nuclear power generation. Kyushu is home to important steel makers (Nissin/Sumitomo) and a growing chunk of Japan’s automobile and high-tech industry. Kyushu Electric is pushing hard to restart two nuclear reactors by this summer and has planned the construction of a coal fired power plant. The company is said to be reluctant to buy solar power, but it will have to swallow a lot more in the future.

Thanks to its sunny climate and the availability of land, Kyushu island is the main hotspot in Japan’s booming solar energy sector. Kagoshima Nanatsujima will soon be overtaken as the biggest facility in the country by an 81 MW plant built by Japanese trading house Marubeni. In addition, Solar Frontier, a 100% subsidiary of the Tokyo-listed company Showa Shell Sekiyu, in which Shell holds a 35% share, announced on March 31st the construction of a 29 MW solar power plant on land adjoining Nagasaki Airport in the western part of Kyushu.

Solar Frontier has large production facilities in Miyazaki on Kyushu where it manufactures CIS (denoting copper, indium, selenium) thin-film solar modules for customers around the world. The company is facing increasing competition from domestic and foreign module manufactures, such as Chinese panel makers RenaSola and Yingli Solar, seeking to benefit from Japan’s growing market. Sales of solar cell modules in Japan doubled last year.

In a hurry

Elsewhere in Japan, big name investors are also crowding in, seeking to profit from the still-generous support being offered.“We see continued strong demand for utility-scale mega solar installations”, says Kyocera’s Ichiro Ikeda. After signing a strategic partnership with Hitachi for the construction of two solar projects in Japan totalling 34 MW, Marco Northland of Toronto and Stockholm-listed Etrion declared to the Japanese press: “We continue to target a solar project pipeline in Japan of at least 100MW under construction or shovel-ready by 2015”.

The president of Chinese company Sky Solar, which is currently constructing a 4 MW solar plant in Mibu, was recently quoted by one of the biggest Japanese newspapers (Yumiuri) as saying: “Japan is one of the world’s most promising markets. We’ll invest ¥30 billion (€ 215 million) annually and develop solar power plants with 400 MW total output in three years.”

Investors are in a hurry. They want to have their projects up and running by 2016 when the liberalization of the Japanese retail energy market will step into the next phase, and the market is expected to become more competitive and dynamic, with new suppliers entering the market. One of these is Masayoshi Son, the outspoken president of the successful Japanese telecommunications company of SoftBank, a major shareholder of the famous Chinese e-commerce company Alibaba. Masayoshi Son, who has been called the Buzz Lightyear of corporate Japan by news wire Nikkei, has declared war on nuclear power and is aggressively putting his money where his mouth is. Last February, the company’s subsidiary SB Energy opened its largest solar farm (43MW) yet, in western Japan. Plans for two more solar farms, both in Kyushu, are underway. With its new solar power capacity, SoftBank is planning to force open the power retail market, the company has said.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica's Comment Policy