Norway’s EVs At A Record 93% Share

September saw plugin EVs at a record 93% share of Norway’s auto market, up from 89.1% year on year. The gains in share came from erosion of combustion vehicle volume, rather than growth in EV volume. Overall auto volume was 10,342 units, down almost 30% YoY. The Tesla Model Y was September’s bestseller.

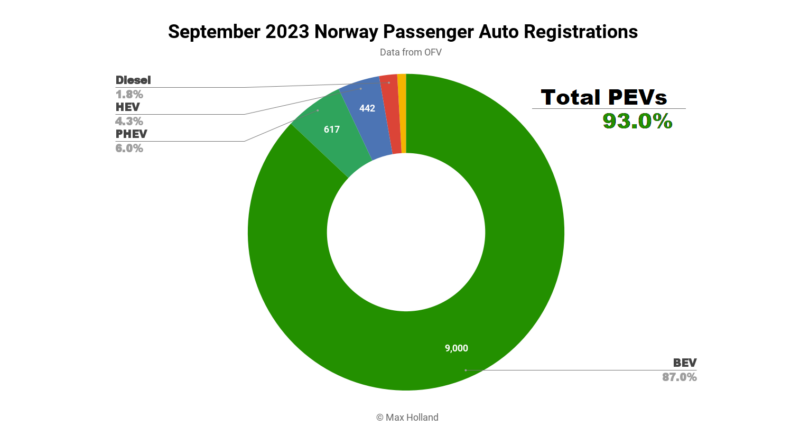

September’s results saw combined EVs at a record 93% share, with BEVs (battery electrics) contributing a record 87.0%, and PHEVs (plugin hybrids) adding another 6.0%. These compare YoY with figures of 89.1%, with 77.7% BEVs, and 11.4% PHEVs.

We can see that BEVs have taken a further 10% of the market, at the expense of all other powertrains, including PHEVs.

Cumulative EV share YTD now stands at 90.4% (with 83.4% BEV), from 87.8% YoY (77.8% BEV). Expect at least 91% by full year end (from 87.8% last year).

In volume terms, September saw all powertrains down YoY, leading to the 29.4% drop in overall auto volume. However, BEVs outpeformed all others, “only” losing 21% of volume YoY (to 9,000 units). All others lost roughly half (or more) of their volume YoY.

With the consumer economy being in a tight squeeze, “People are experiencing noticeably tighter times and have sat on the fence, that is, they are keeping the car they have for a while longer,” said OFV director Øyvind Solberg Thorsen (machine translation).

Combustion-only powertrains were particularly hard hit in September. Combined, they scored a record low of 2.7% share, down YoY from 5.3%. Petrol-only saw just 93 unit sales, and diesel-only saw 190.

Bestsellers

September being an end-of-quarter month, Tesla’s shipping was at high flow, with the Tesla Model Y taking overall bestseller at 2,472 units. This was more volume than the next 6 models combined.

The Skoda Enyaq took the second spot, with the Ford Mach-e coming in third, just a whisker ahead of the Toyota BZ4X.

The Ford Mach-e was at its highest volume since December 2022, allowing it to climb to third from its more typical 7th or 8th spot.

Usually in the top three, the Volkswagen ID.4 was in the doldrums in September, at its lowest volume since February 2022 (if we exclude the market-wide hangover of January 2023).

There was one welcome surprise entry to the top 20, and a new debut model, the Fisker Ocean. It saw 175 registrations, securing 10th position. We will have to wait to see whether this was an initial bulk delivery to satisfy early reservation holders, or whether this kind of volume might be sustained (or grow) over the coming months. The Ocean is certainly a compelling vehicle and deserves to do well, but it may take a while for production to rise to meet potential demand.

There were other important newcomers in September.

The Smart #1 saw its first Norwegian deliveries, just an initial 4 units to break the ice. This is a compelling small SUV, a twin of the upcoming Volvo EX30, at a fairly competitive price point, and may do well in Norway.

Also debuting in September was the Xpeng G9, a large premium SUV, seeing an initial 12 units. Check the Sweden report for more info on this competitively priced new SUV.

Last but not least, the new BMW i5 made its first deliveries to Norway, with 20 units. Sedans are not very popular in Norway, with 9 of the top 10 being SUVs or Minibuses (see chart below). Yet, the BMW i5’s smaller sibling, the BMW i4, has carved out a solid spot in the top 20, so the i5 – even at its premium price – may have potential to do reasonably well in this market. Early reviews suggest it is a compelling and well balanced vehicle.

Now let’s turn to the model performance over the trailing 3 months:

Here the Tesla Model Y’s lead is clear to see, more than the combined volume of the 2nd place Skoda Enyaq and 3rd place Volkswagen ID.4.

However, the Model Y’s volume has actually fallen by 39% from Q2’s 6,731 units. The combined volume of the Enyaq and ID.4 has remained almost flat.

Note that Q3’s overall BEV market volume was 24,398 units, compared to 31,045 in Q2, a drop of 21%, so the Tesla is below par, whilst the others are above it. All of this may reflect allocation decisions rather than changing demand patterns.

In fourth spot, the Toyota BZ4X (1,032 units) has climbed strongly over the Q2 period (644 units), but volumes are still down on its big push in Q1 (1,651 units, and second place).

The MG4 continues to steadily climb up the chart, now in 11th spot, from 19th in the previous period. It’s volume is actually less than previously, but it is ahead of that average 21% QoQ drop mentioned above.

The Citroen e-C4, in 17th place, is back in the top 20 chart for the first time since Q3 2022. It’s a very well balanced vehicle on price and ability (especially now updated with 10% larger battery, even greater efficiency, and great charging), and has a magic carpet ride that is the envy of vehicles at much higher price points.

For fleet-transition updates, check last month’s report.

Outlook

The comments from the OFV director, mentioned above, refer to a tightening economic situation, that is affecting the auto market, and BEV sales volumes. The overall Norwegian economy has slowed, with latest figures showing 0% GDP growth. Inflation remains high though improving, currently at 4.8%, and interest rates continue to rise, at 4.25%, the highest level since 2008-2009.

As the OFV points out, all of this is putting a squeeze on consumer spending, with car owners delaying the point at which they would usually shop for a new vehicle. Whilst BEVs are still the strongly preferred choice for those who do go ahead and buy, due to the market-wide fence sitting, even BEV volumes are down. This means the the speed of the fleet transition is slowed from what it has been previously.

What are your thoughts on Norway’s transition to EVs? Please join the discussion in the comments section below.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

CleanTechnica's Comment Policy